Protect Your Assets

Let us help you protect your home, car and other assets.

Stop Harassing Calls

Immediately stop unwanted collection calls & harassment with your case filing.

Get Out of Debt

Resolve your debt and get a financial fresh start ethically and legally with bankruptcy.

Ascent Law has a team of some of the most experienced and knowledgeable Salt Lake bankruptcy Lawyers. We understand what you are going through. Few things in life are as stressful as harassing phone calls from creditors, wage garnishment, foreclosure and repossession. We understand the stress you are under constantly thinking about which of your payments you can afford to pay?

You’re may also be stressing out about the stigma of potential wage garnishments? This is a common response, and you need to know that you are not alone in your situation, and you won’t be alone with the help of our services.

Do You Need Assistance With Eliminating Debt?

Following are some warning signs that you may need to get professional help in order to get your finances back in order:

• Using your credit cards to pay bills

• Borrowing from your retirement account

• Borrowing from family and friends

• past due on credit cards, vehicles, home, and/or rent

• Received a foreclosure notice

• Denied for new lines of credit

• Overwhelmed with debt

• Harassing phone calls from creditors

Contact Us

Cheap Bankruptcy Salt Lake

File Your case For Only $200

Our Affordable Bankruptcy program allows you to get a chapter 7 case filed for only $200. That’s right, only $200 gets your bankruptcy case relief. Find out how we can help you!

Our experienced and knowledgeable Salt Lake bankruptcy lawyers can evaluate your situation

Salt Lake Chapter 7 Bankruptcy

Salt Lake Chapter 7 is a liquidation of non-exempt property in exchange for a discharge of your debts. All of your property is designated either as “exempt”, which is protected, or non-exempt, which is unprotected. Any unprotected property may be sold or liquidated (hence the term liquidation) on behalf of your creditors. Most people that file for chapter 7 don’t lose any property because they don’t have any non-exempt property. Our Tooele Bankruptcy Attorney will help you understand your situation and guide you through the entire process.

Find out how our experienced bankruptcy lawyer can help you protect your property in bankruptcy. Schedule your free Utah bankruptcy consultation today!

Salt Lake Chapter 13 Bankruptcy

Salt Lake Chapter 13 is a protection that allows you to consolidate your debts and repay them (or a portion) based on your disposable income. Your disposable income is your monthly income less your monthly necessary expenses. The repayment plan will normally last between 36 and 60 months. Chapter 13 has powerful tools to restructure or rehabilitate secured debts like your mortgage, if you are past due, recover a repossessed auto, restructure interest rates, and in some cases reduce the principal balance.

To find out how chapter 13 can help you, schedule a free consultation today!

Bankruptcy Benefits

Bankruptcy is the legal and ethical way to deal with debts that you cannot afford. There are different chapters, which may impact you differently. Some of the benefits of bankruptcy include:

- Relieve Stress

- Eliminate credit cards, medical & payday debts

- Eliminate eviction & repossession deficiencies

- Stop Wage Garnishment

- Stop Repossession

- Stop Collection Calls

- Stop Foreclosure

- Repair Credit

Choose Your Payment

We let you choose a low cost upfront payment–that’s how committed we are to making filing bankruptcy as flexible as possible. Our goal is to making filing bankruptcy as simple, affordable, and convenient as possible. That’s why we’ve spent so much time finding ways to make it easier for you.

Provide Documents

Before we can file your case we will need copies of essential documents & information. You get this together now, so that you have everything in order to file quickly.

- Copy of your driver’s license for each party filing.

- Copy of your social security card (or original W-2) for each party filing.

- The last 7 months of all pay for each party filing.

- Copies of your state and federal tax returns for the 2 most recent years filed.

- Completion of our Questionnaire.

- Completion of the credit counseling course (you will receive instructions in a subsequent email)

Stop Creditors

As soon as your case is file the bankruptcy automatic stay immediately becomes effective stopping garnishments, creditor harassment, repossession, foreclosure, eviction and other creditor collections.

Our West Jordan office serves all of Salt Lake, including Alta, Bluffdale, Copperton, Cottonwood Heights, Draper, Herriman, Holladay, Kearns, Magna, Midvale, Riverton, Salt Lake City, Sandy, South Jordan, Taylorsville, & West Valley.

504 W 800 N

Orem, UT 84057

707 24th St. Ste. 2-A

Ogden, UT 84401

8833 S Redwood Rd Ste C

West Jordan, UT 84088

1079 E Riverside Dr Ste 203

St George, UT 84790

Salt Lake City

|

Salt Lake City, Utah

|

|

|---|---|

| City of Salt Lake City[1] | |

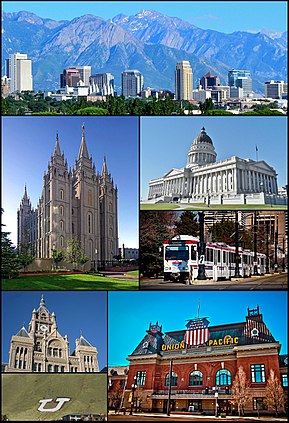

Clockwise from top: The skyline in July 2011, Utah State Capitol, TRAX, Union Pacific Depot, the Block U, the City-County Building, and the Salt Lake Temple

|

|

| Nickname:

“The Crossroads of the West”

|

|

Interactive map of Salt Lake City

|

|

Coordinates:  40°45′39″N 111°53′28″WCoordinates: 40°45′39″N 111°53′28″WCoordinates:  40°45′39″N 111°53′28″W 40°45′39″N 111°53′28″W |

|

| Country | |

| State | Utah |

| County | Salt Lake |

| Platted | 1857; 165 years ago[2] |

| Named for | Great Salt Lake |

| Government

|

|

| • Type | Strong Mayor–council |

| • Mayor | Erin Mendenhall (D) |

| Area | |

| • City | 110.81 sq mi (286.99 km2) |

| • Land | 110.34 sq mi (285.77 km2) |

| • Water | 0.47 sq mi (1.22 km2) |

| Elevation

|

4,327 ft (1,288 m) |

| Population | |

| • City | 199,723 |

| • Rank | 122nd in the United States 1st in Utah |

| • Density | 1,797.52/sq mi (701.84/km2) |

| • Urban

|

1,021,243 (US: 42nd) |

| • Metro

|

1,257,936 (US: 47th) |

| • CSA

|

2,606,548 (US: 22nd) |

| Demonym | Salt Laker[5] |

| Time zone | UTC−7 (Mountain) |

| • Summer (DST) | UTC−6 |

| ZIP Codes | |

| Area codes | 801, 385 |

| FIPS code | 49-67000[7] |

| GNIS feature ID | 1454997[8] |

| Major airport | Salt Lake City International Airport |

| Website | Salt Lake City Government |

Salt Lake City (often shortened to Salt Lake and abbreviated as SLC) is the capital and most populous city of Utah, as well as the seat of Salt Lake County, the most populous county in Utah. With a population of 199,723 in 2020,[10] the city is the core of the Salt Lake City metropolitan area, which had a population of 1,257,936 at the 2020 census. Salt Lake City is further situated within a larger metropolis known as the Salt Lake City–Ogden–Provo Combined Statistical Area, a corridor of contiguous urban and suburban development stretched along a 120-mile (190 km) segment of the Wasatch Front, comprising a population of 2,606,548 (as of 2018 estimates),[11] making it the 22nd largest in the nation. It is also the central core of the larger of only two major urban areas located within the Great Basin (the other being Reno, Nevada).

Salt Lake City was founded July 24, 1847, by early pioneer settlers, led by Brigham Young, who were seeking to escape persecution they had experienced while living farther east. The Mormon pioneers, as they would come to be known, entered a semi-arid valley and immediately began planning and building an extensive irrigation network which could feed the population and foster future growth. Salt Lake City’s street grid system is based on a standard compass grid plan, with the southeast corner of Temple Square (the area containing the Salt Lake Temple in downtown Salt Lake City) serving as the origin of the Salt Lake meridian. Owing to its proximity to the Great Salt Lake, the city was originally named Great Salt Lake City. In 1868, the word “Great” was dropped from the city’s name.[12]

Immigration of international members of The Church of Jesus Christ of Latter-day Saints, mining booms, and the construction of the first transcontinental railroad initially brought economic growth, and the city was nicknamed “The Crossroads of the West”. It was traversed by the Lincoln Highway, the first transcontinental highway, in 1913. Two major cross-country freeways, I-15 and I-80, now intersect in the city. The city also has a belt route, I-215.

Salt Lake City has developed a strong tourist industry based primarily on skiing and outdoor recreation. It hosted the 2002 Winter Olympics. It is known for its politically progressive and diverse culture, which stands at contrast with the rest of the state’s conservative leanings.[13] It is home to a significant LGBT community and hosts the annual Utah Pride Festival.[14] It is the industrial banking center of the United States.[15] Salt Lake City and the surrounding area are also the location of several institutions of higher education including the state’s flagship research school, the University of Utah. Sustained drought in Utah has more recently strained Salt Lake City’s water security and caused the Great Salt Lake level drop to record low levels,[16][17] and impacting the state’s economy, of which the Wasatch Front area anchored by Salt Lake City constitutes 80%.[18]

About Salt Lake City, Utah

Neighborhoods in Salt Lake City, Utah

Poplar Grove, The Avenues, Ballpark, Lower Avenues, Downtown, Woodbury, Central City, Neighborhood House, Salt Lake City Community Development, Rio Grande, The Neighborhood Hive, Neighborhood Services, University Neighborhood Partners, Salt Lake City, Neighborhood Auto Service, Sunnyside Park, Building at Rear, 537 West 200 South, Washington Square Park, Area 51, Brigham Young Historic Park

Things To Do in Salt Lake City, Utah

Bus Stops in Salt Lake City, Utah to Ascent Law LLC

Bus Stop in Greyhound: Bus Station Salt Lake City, Utah to Ascent Law LLC

Bus Stop in Greyhound: Bus Stop Salt Lake City, Utah to Ascent Law LLC

Bus Stop in Salt Lake Central Salt Lake City, Utah to Ascent Law LLC

Bus Stop in Stadium Station (EB) Salt Lake City, Utah to Ascent Law LLC

Bus Stop in South Salt Lake City Station Salt Lake City, Utah to Ascent Law LLC

Bus Stop in Intermodal Hub – Salt Lake City Salt Lake City, Utah to Ascent Law LLC

Bus Stop in Salt Lake Central Station (Bay B) Salt Lake City, Utah to Ascent Law LLC

Bus Stop in State St @ 1428 S Salt Lake City, Utah to Ascent Law LLC

Bus Stop in 200 S / 1000 E (EB) Salt Lake City, Utah to Ascent Law LLC

Bus Stop in Beck Street @ 1765 N (Salt Lake) Salt Lake City, Utah to Ascent Law LLC

Bus Stop in 200 S / 1100 E (Wb) Salt Lake City, Utah to Ascent Law LLC

Bus Stop in State St @ 1601 S Salt Lake City, Utah to Ascent Law LLC

Map of Salt Lake City, Utah

Driving Directions in Salt Lake City, Utah to Ascent Law LLC

Driving Directions from The Grand America Hotel to Salt Lake City, Utah

Driving Directions from Hilton Salt Lake City Center to Salt Lake City, Utah

Driving Directions from The Little America Hotel – Salt Lake City to Salt Lake City, Utah

Driving Directions from Kimpton Hotel Monaco Salt Lake City to Salt Lake City, Utah

Driving Directions from Salt Lake City Marriott City Center to Salt Lake City, Utah

Driving Directions from Crystal Inn Hotel & Suites Salt Lake City to Salt Lake City, Utah

Driving Directions from Hampton Inn Salt Lake City-Downtown to Salt Lake City, Utah

Driving Directions from Hilton Garden Inn Salt Lake City Downtown to Salt Lake City, Utah

Driving Directions from Salt Lake Marriott Downtown at City Creek to Salt Lake City, Utah

Driving Directions from Salt Lake Plaza Hotel SureStay Collection By Best Western to Salt Lake City, Utah

Driving Directions from Homewood Suites by Hilton Salt Lake City-Downtown to Salt Lake City, Utah

Driving Directions from Radisson Hotel Salt Lake City Downtown to Salt Lake City, Utah

Reviews for Ascent Law LLC Salt Lake City, Utah

John Logan

We’ve gotten divorce and child custody work from Ascent Law since the beginning because of my ex. We love this divorce firm! Staff is gentle, friendly and skilled. Tanya knows her stuff. Nicole is good and Ryan is fun. Really, all the staff here are careful, kind and flexible. They always answer all my questions, explain what they’re doing and provide great legal services. I personally think they are the best for divorce in Utah.

Jacqueline Hunting

I have had an excellent experience with Ascent Law, Michael Reed is an absolutely incredible attorney. He is 100% honest and straight forward through the entire legal process of things, he also has a wonderful approach to helping better understand certain agreements, rights, and legal standing of matters, to where it was easy to know whats going on the entire process. I appreciate the competency, genuine effort put forth, and assistance I received from Ascent and attorney Michael Reed, and I will be calling these guys if ever I have the need again for their legal assistance! 5star review Wonderful attorneys!

Anthony Ziegler

This review is well deserved for Ryan and Josh. New clients should know they are worth the 5 star rating we give them. We needed 2 sessions from them because of the complexity of the matter, but they are both very passionate about his helping others in need. My sister needed bankruptcy and I needed divorce. Sometimes they go hand in hand but a large shout out to this team – also Nicole is one of the sweetest people you ever did meet – she offered me warm cookies!

Thomas Parkin

Mike Anderson and his colleagues & staff are knowledgeable, attentive and caring. In a difficult and complex case that eventually went to trial, Mike was the voice of reason and the confidence I needed. His courtroom abilities are amazing and I felt his defense of me was incredible. His quick thinking and expertise allowed for a positive result when I felt the World was crumbling. His compassion, after the case, has helped me return to a good life. I trust Mike and his staff. They are friendly and very good at what they do.

Yeran Merry

I worked with Attorney Alex and Paralegal Ami in my divorce case. I got to know the team very well over the course of two years. I cannot think of a better team to have worked with. Ami and Alex are not only exceptional law professions who are very knowledgeable and thorough, they are also the best human beings who empathize with the emotions I was experiencing. Alex was conscious of my budget and worked efficiently to try to reduce unnecessary legal expenses. My case also involved some dealings with a foreign country that Alex and his team had previously dealt with. They did an amazing job addressing cultural barriers in a very respectful manner and did not fall short in quality of work or in standards when dealing with some of these new challenges. Ami deserves a medal for being extremely professional, calming, and compassionate when it is needed most. When you need family law attorneys, call this firm. I now feel I can move forward with grace and dignity.